How I Grew My Wealth Without Crossing the Tax Line

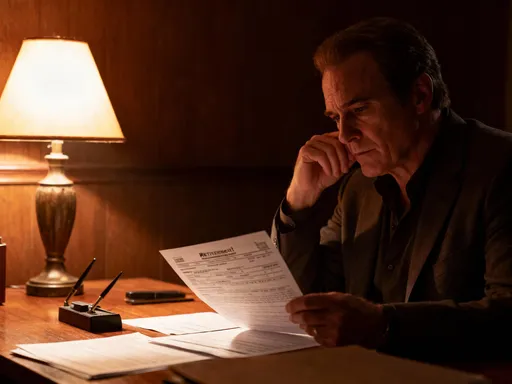

What if you could grow your wealth while staying fully on the right side of the law? I’ve been there—confused, overwhelmed, and scared of making a costly mistake. After years of testing strategies, learning from missteps, and fine-tuning my approach, I discovered that smart wealth growth isn’t about loopholes—it’s about working with the system. This is how I built long-term value without inviting audits or penalties. By focusing on tax-aware decisions, strategic timing, and disciplined planning, I preserved more of what I earned. The journey wasn’t about chasing quick wins but building a resilient financial foundation. And the best part? Every step was compliant, transparent, and sustainable.

The Hidden Cost of Ignoring Tax Compliance

Tax compliance is often seen as a burden, a necessary evil tacked onto the end of investing. But in reality, overlooking tax implications can quietly erode years of hard-earned gains. Many investors fixate on pre-tax returns, celebrating a 12% annual growth without realizing that half of that gain could vanish in taxes. The truth is, the tax consequences of financial decisions are not an afterthought—they are central to the outcome. When investors fail to account for how their choices impact their tax liability, they risk turning a profitable year into a financial setback. Capital gains, dividends, interest income, and even retirement withdrawals all carry tax responsibilities. Ignoring these can lead to surprise bills, underpayment penalties, or worse—triggering audits that consume time, money, and peace of mind.

Consider the case of someone who sells a stock held for less than a year, triggering short-term capital gains taxed at ordinary income rates. If they’re in the 32% tax bracket, nearly a third of their profit disappears before they see a dollar. Contrast that with holding the same asset just a few months longer to qualify for long-term rates, which could be as low as 15%. That difference compounds over time, significantly affecting portfolio growth. Misclassifying income—such as treating passive income as ordinary income—can also lead to overpayment. Even seemingly small oversights, like failing to report a $500 interest payment from a savings account, can trigger IRS notices and create a paper trail of noncompliance.

Another common pitfall is the misunderstanding of retirement account rules. Withdrawing from a traditional IRA before age 59½ typically incurs a 10% early withdrawal penalty in addition to income taxes. Yet, many individuals tap into these funds during emergencies without realizing the full cost. Similarly, required minimum distributions (RMDs) begin at age 73 under current law, and failing to take them results in a steep 25% penalty on the amount not withdrawn. These are not obscure regulations—they are foundational to tax-aware investing. The cost of ignorance is not just financial; it’s psychological. Stress, anxiety, and loss of confidence often follow when investors realize they’ve made avoidable mistakes.

The shift in mindset begins with recognizing that tax compliance is not an obstacle but a strategic advantage. When integrated into financial planning from the start, it allows investors to anticipate liabilities, optimize timing, and structure holdings efficiently. This proactive approach turns tax obligations from a source of fear into a tool for control. Just as a homeowner inspects a property before purchase, a prudent investor examines the tax implications of every financial decision. Over time, this discipline compounds just like interest—quietly, steadily, and powerfully.

Asset Allocation That Works With the System, Not Against It

Most discussions about asset allocation focus on balancing risk and return. But a truly effective strategy must also consider tax efficiency. Different asset classes generate different types of income, and each is treated differently by the tax code. Equities may produce long-term capital gains and qualified dividends, both of which benefit from favorable tax rates. Bonds typically generate interest income, taxed at ordinary rates. Real estate can offer depreciation benefits and potential 1031 exchange opportunities. Alternatives like private equity or commodities may have complex tax treatments. The key is not just what you own, but where you hold it.

Taxable accounts, tax-deferred accounts like traditional IRAs and 401(k)s, and tax-free accounts such as Roth IRAs each serve distinct purposes. Placing high-growth, high-dividend stocks in a taxable account may seem logical, but it can lead to an annual tax bill on dividends and capital gains. A smarter approach is to hold these assets in tax-advantaged accounts, where growth can compound without annual tax interruptions. Conversely, municipal bonds, which generate tax-exempt interest, are better suited for taxable accounts since their benefit is lost in a tax-deferred environment. This concept—known as asset location—is a powerful lever for improving after-tax returns.

For example, imagine an investor holds a stock fund that yields 3% in dividends annually. In a taxable account, those dividends are subject to tax each year, reducing net returns. But if the same fund is held in a Roth IRA, the dividends grow tax-free and can be withdrawn tax-free in retirement. Over 20 years, the difference in compounding can amount to tens of thousands of dollars. Similarly, holding tax-inefficient investments like real estate investment trusts (REITs) or high-turnover mutual funds in retirement accounts shields their distributions from current taxation. This strategic placement allows more capital to remain invested and working over time.

Another consideration is international investments. Foreign dividends may be subject to withholding taxes, but certain accounts allow for foreign tax credits, reducing the overall burden. Understanding these nuances enables investors to structure portfolios that align with both financial goals and tax realities. The goal is not to avoid taxes—because that’s neither legal nor sustainable—but to minimize unnecessary tax drag. By aligning asset types with account types, investors gain a quiet but meaningful edge. This approach doesn’t require complex maneuvers; it requires intention. And over decades, intention compounds into substantial financial advantage.

Timing Matters: When to Buy, Hold, and Sell

Investing success isn’t just about picking the right assets—it’s about choosing the right moment to act. The timing of buying, holding, and selling decisions has a direct impact on tax liability. One of the most significant distinctions in tax law is between short-term and long-term capital gains. Assets held for one year or less are subject to short-term gains, taxed at ordinary income rates. Those held longer qualify for long-term rates, which are substantially lower for most taxpayers. This single rule makes the difference between losing nearly half your gain to taxes or keeping most of it.

Consider an investor who buys shares for $10,000 and sells them a year and a day later for $15,000. That $5,000 gain is taxed at the long-term rate—say, 15%—resulting in a $750 tax. But if the same investor sells just one day earlier, the gain is taxed at their ordinary rate—perhaps 24%—leading to a $1,200 tax. That extra 11 months of holding saves $450. While this may seem modest, repeated across multiple transactions and over decades, the savings become transformative. Patience, in this case, isn’t just a virtue—it’s a financial strategy.

Tax-loss harvesting is another timing-based strategy that allows investors to offset gains. When an investment declines in value, selling it locks in a loss that can be used to reduce taxable gains. For example, if an investor realizes a $3,000 gain on one stock but sells another for a $2,000 loss, they only pay tax on $1,000 of net gain. Up to $3,000 in net losses can also be deducted against ordinary income annually, with additional losses carried forward. This technique turns market downturns into tax planning opportunities without changing long-term investment goals.

However, investors must be aware of the wash-sale rule, which disallows a loss deduction if a “substantially identical” security is purchased within 30 days before or after the sale. This rule prevents abuse but doesn’t eliminate the strategy’s value. By waiting 31 days or choosing a similar but not identical investment, investors can maintain market exposure while preserving the tax benefit. Timing also applies to retirement planning. Delaying Social Security benefits or Roth conversions in low-income years can reduce lifetime tax burdens. Strategic timing isn’t about market timing—it’s about tax-aware decision-making. It transforms emotional reactions into deliberate actions, turning tax season into a predictable, manageable part of financial life.

Structuring Investments for Long-Term Advantage

How you hold your investments can be just as important as what you hold. Ownership structure—whether as an individual, joint owner, trust, or through retirement accounts—shapes your tax outcome. Each structure comes with distinct rules, benefits, and responsibilities. Choosing the right one isn’t about complexity; it’s about alignment with long-term goals. For most individuals, retirement accounts like IRAs and 401(k)s are foundational. These vehicles offer tax deferral, meaning contributions may be tax-deductible, and earnings grow without annual taxation. This allows compounding to occur on a larger base, accelerating wealth accumulation.

Traditional IRAs and 401(k)s provide upfront tax benefits, reducing taxable income in the contribution year. However, withdrawals in retirement are taxed as ordinary income. Roth versions, on the other hand, require after-tax contributions but allow tax-free withdrawals in retirement, including all growth. For those expecting to be in a higher tax bracket later—or who value tax-free income flexibility—the Roth option can be powerful. Health Savings Accounts (HSAs) offer a triple tax advantage: contributions are tax-deductible, growth is tax-deferred, and withdrawals for qualified medical expenses are tax-free. This makes HSAs not only a healthcare tool but a stealth retirement savings vehicle.

Education savings plans like 529 accounts also provide tax-free growth when used for qualified education expenses. While not a retirement tool, they serve families aiming to support children’s futures without derailing their own financial plans. Trusts, while more complex, can provide estate planning benefits and controlled distribution of assets. Revocable living trusts, for example, avoid probate but don’t change tax treatment during the grantor’s life. Irrevocable trusts can remove assets from an estate, potentially reducing estate taxes, but come with loss of control and strict rules.

The key is to use these structures intentionally. Contributing the maximum to a 401(k) isn’t just about saving—it’s about reducing taxable income today while building future wealth. Converting a traditional IRA to a Roth IRA in a low-income year can lock in lower taxes on the converted amount. These decisions require planning, but they pay off in long-term efficiency. The goal isn’t to hide money but to position it where it grows most effectively under the law. When structured wisely, investments don’t just grow—they grow smarter.

Leveraging Tax-Efficient Instruments

Not all investments are created equal when it comes to tax efficiency. Two funds with identical returns can deliver very different after-tax results based on their structure and turnover. Index funds and exchange-traded funds (ETFs) are often more tax-efficient than actively managed mutual funds because they typically have lower turnover. Every time a fund manager sells a holding at a profit, it may distribute capital gains to shareholders, triggering a tax bill—even if the investor didn’t sell a share. Low-turnover funds generate fewer of these taxable events, allowing more of the return to stay in the investor’s pocket.

ETFs have an additional structural advantage: the “in-kind” creation and redemption process, which allows them to minimize capital gains distributions. This means investors in ETFs are less likely to receive surprise tax bills from fund activity they didn’t initiate. For example, an investor holding a broad-market ETF may see consistent growth with minimal annual taxation, while a similar mutual fund might distribute gains annually, creating an ongoing tax liability. Over time, this difference in tax drag can significantly affect net returns.

Municipal bonds are another powerful tax-efficient instrument. The interest they generate is typically exempt from federal income tax and, if issued by a state or local government within the investor’s home state, may also be exempt from state and local taxes. For someone in a high tax bracket, this can make a seemingly low-yielding municipal bond more attractive than a higher-yielding taxable bond after taxes. For instance, a 3% tax-exempt yield is equivalent to a 4.4% taxable yield for someone in the 32% bracket. This tax-equivalent yield calculation is essential for making fair comparisons.

Dividend-focused investors can also benefit from holding stocks that pay qualified dividends, which are taxed at long-term capital gains rates rather than ordinary income rates. However, not all dividends qualify—those from real estate investment trusts or certain foreign corporations may be taxed at higher rates. Understanding these distinctions helps investors build portfolios that generate income without unnecessary tax burdens. The goal isn’t to eliminate taxes entirely—that’s neither possible nor legal—but to reduce avoidable friction. By choosing instruments designed for efficiency, investors keep more of what they earn, letting compounding work its full magic.

Staying Compliant Without Overcomplicating Things

In the pursuit of tax efficiency, some investors fall into the trap of overcomplicating their strategies. They adopt aggressive schemes, layer on complex structures, or rely on questionable advice—all in the name of saving a few more dollars. But complexity often attracts scrutiny. The IRS is more likely to audit returns with unusual deductions, foreign accounts, or inconsistent reporting. Simplicity, transparency, and consistency are not only safer—they are more effective in the long run. A clean, well-documented return filed on time is worth far more than a risky strategy that saves a few hundred dollars but invites investigation.

Accurate record-keeping is one of the most powerful tools for compliance. Keeping track of purchase dates, cost basis, dividend payments, and sale proceeds ensures that tax reporting is accurate and defensible. Digital tools and brokerage statements make this easier than ever. Working with a trusted tax professional or financial advisor adds another layer of protection. They can identify legitimate opportunities, ensure proper filing, and help navigate changes in tax law without crossing the line.

Common pitfalls include failing to report foreign financial accounts (required if total value exceeds $10,000 at any time during the year), misusing retirement accounts for non-qualified expenses, or misunderstanding the rules around home office deductions. These aren’t just technicalities—they are legal requirements. The consequences of noncompliance can include penalties, interest, and loss of credibility with tax authorities. But the good news is that most issues are preventable. By focusing on honesty and diligence, investors can build a reputation for integrity—one that pays dividends in peace of mind.

The goal isn’t to minimize taxes at all costs but to optimize within the rules. This means taking every legal deduction and credit available—such as the Saver’s Credit for retirement contributions or the Child Tax Credit for families—but doing so with proper documentation and eligibility. It means filing on time, paying what’s due, and correcting mistakes promptly. A compliant financial life isn’t restrictive; it’s liberating. It allows investors to focus on growth, not fear, knowing they’ve built their wealth on solid, legal ground.

Building a Sustainable Wealth Strategy for the Future

True wealth isn’t measured by how much you earn, but by how much you keep and how long it lasts. The strategies outlined in this article—tax-aware asset allocation, strategic timing, proper structuring, and the use of efficient instruments—are not quick fixes. They are components of a sustainable, long-term approach to financial health. When applied consistently, they create a compounding effect that extends beyond dollars and cents. They build confidence, reduce stress, and foster a sense of control over one’s financial destiny.

Tax planning should not be an annual chore reserved for April. It should be woven into the fabric of financial decision-making year-round. Every investment choice, every sale, every contribution to a retirement account is an opportunity to align with the tax code rather than fight it. This mindset shift—from avoidance to integration—transforms tax compliance from a burden into a strategic ally. It allows investors to grow wealth not by outsmarting the system, but by working within it wisely.

The most successful investors aren’t those who take the biggest risks or chase the highest returns. They are the ones who stay disciplined, patient, and compliant. They understand that lasting financial freedom comes not from shortcuts, but from consistent, thoughtful actions taken over time. They value security over spectacle, sustainability over speed. And in the end, they are the ones who sleep well at night, knowing their wealth is not just growing—but growing the right way.