What I Learned About Retirement Investing the Hard Way – And Why It Actually Works

Growing up, I never thought about retirement. By my 50s, I realized I was behind—way behind. But instead of panicking, I started learning. Real learning. Not from textbooks, but from real choices: what to invest in, when to pull back, and how to protect what I had. This is the story of how I rebuilt my retirement plan through education, smart moves, and a few painful lessons. No jargon. No promises. Just what actually worked. It wasn’t about getting rich overnight or chasing trends. It was about understanding my financial reality, making informed decisions, and staying consistent even when progress felt slow. What I discovered changed not only my financial future but also my sense of control and peace in the second half of life.

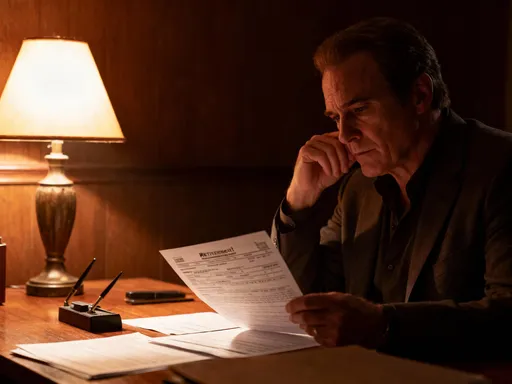

The Wake-Up Call: Facing My Retirement Reality

For most of my adult life, retirement was a distant idea—something that would sort itself out when the time came. I paid into retirement accounts when my employer offered them, but I never looked closely at the balances, performance, or fees. I assumed that decades of contributions would be enough. By the time I turned 58, that assumption collapsed. A minor heart issue landed me in the hospital for a few days, and during that quiet, uncomfortable time, I faced a truth I’d long avoided: my savings were not going to support the kind of retirement I imagined. I had less than $120,000 spread across three old 401(k)s and a small IRA, with most of it invested in high-fee mutual funds that barely kept up with inflation. My Social Security estimate, while helpful, wouldn’t cover even half of my basic monthly expenses if I stopped working.

That health scare was a pivot point. It wasn’t just about money—it was about dignity, independence, and the ability to age without constant worry. I realized I had two choices: keep hoping things would work out, or take real action. I chose action. I began by reaching out to my local library and community center, where I learned they offered free financial literacy workshops for adults. These weren’t sales pitches disguised as education; they were practical, no-cost sessions led by certified financial educators. I attended every one I could. I learned how compound interest works, why asset allocation matters, and how fees silently erode long-term growth. I discovered that I didn’t need a financial genius to manage my money—just discipline, clarity, and a willingness to learn. What started as fear slowly transformed into motivation. I began treating my financial recovery like a part-time job, dedicating a few hours each week to reading, researching, and planning. This was no longer about catching up—it was about building a future I could rely on.

Why Late-Life Financial Education Changes Everything

Many people believe financial education is most valuable when you’re young, with decades of compounding ahead. While that’s true, I found that learning later in life carries a unique power: urgency. When you’re in your 50s or 60s, financial decisions aren’t abstract. They’re immediate. Every dollar saved, every fee reduced, every investment rebalanced has a direct impact on your quality of life in retirement. I wasn’t studying for a test—I was preparing for survival. This gave every lesson weight. In one workshop, we analyzed a case study about a couple who retired at 65 with $200,000 and withdrew 5% annually. By adjusting their withdrawal rate to 4% and shifting to a more balanced portfolio, they extended their savings by nearly ten years. That wasn’t just a statistic to me—it was a lifeline.

I began to understand that financial literacy isn’t about memorizing terms like “alpha” or “beta.” It’s about grasping core principles: diversification reduces risk, fees matter more than most people realize, and emotional decisions often lead to losses. I learned to read a fund’s prospectus and identify expense ratios. I discovered the difference between a target-date fund and an index fund—and why the latter often serves retirees better due to lower costs and broader market exposure. Most importantly, I learned to ask questions instead of accepting what I was told. When a financial advisor suggested I invest in a high-commission annuity, I paused. I went home, researched it, and realized it wasn’t aligned with my goals. That moment of hesitation, born from education, saved me thousands of dollars in unnecessary fees and long-term restrictions.

Another benefit of late-life learning is perspective. I wasn’t trying to build a fortune—I was trying to protect what I had and ensure it lasted. That clarity helped me avoid the temptation of speculative investments or “hot tips” from well-meaning friends. I focused instead on stability, income, and capital preservation. I also found strength in peer discussions. In the workshops, I met others in similar situations—people who had delayed planning, underestimated healthcare costs, or relied too heavily on home equity. Sharing stories made me feel less alone and more determined. We weren’t failures—we were late starters, and it wasn’t too late to change course. Education didn’t just give me knowledge; it gave me confidence. And confidence, I learned, is one of the most valuable assets a retiree can have.

My Investment Strategy: Balancing Growth and Safety

When I began rebuilding my portfolio, I made one guiding rule: do not lose money unnecessarily. That doesn’t mean avoiding all risk—some risk is necessary for growth—but it does mean being intentional about where and why I took it. I shifted my focus from chasing high returns to building a portfolio that could generate steady income with minimal volatility. I moved away from individual stocks and high-fee mutual funds and into low-cost, diversified options. I allocated about 60% of my portfolio to bond ETFs that provided regular interest payments, including U.S. Treasury bonds, municipal bonds, and investment-grade corporate bonds. These aren’t glamorous, but they offer stability and predictable income, especially during market downturns.

About 30% went into dividend-paying stock funds, particularly those focused on established companies with a history of increasing payouts over time. These aren’t speculative tech startups but companies in sectors like utilities, consumer staples, and healthcare—businesses people rely on every day. The dividends provide a cash flow that I can reinvest or use to cover expenses, and the stocks themselves have the potential to grow modestly over time. The remaining 10% is in inflation-protected securities like TIPS (Treasury Inflation-Protected Securities) and real estate investment trusts (REITs), which help preserve purchasing power as the cost of living rises. I also opened a Roth IRA and began making small, regular contributions, knowing that tax-free withdrawals in retirement could give me more flexibility later.

One of the most important changes I made was setting a schedule for rebalancing. I review my portfolio twice a year—once in the spring and once in the fall. If one asset class has grown too large or shrunk too much, I adjust to bring it back to my target allocation. This simple habit keeps my risk level consistent and prevents emotional decisions during market swings. For example, after a strong year for stocks, I might sell a small portion of my equity funds and move that money into bonds to maintain balance. This isn’t about timing the market—it’s about staying on track. I also automated my contributions to my retirement accounts, even if the amounts are small. Consistency matters more than size. Over time, these disciplined choices have built a foundation I can trust, even when the headlines are grim.

Risk Control: Protecting My Nest Egg from Big Mistakes

One of the biggest lessons I learned is that the greatest threats to retirement savings often come not from the market, but from human behavior. Fear and greed lead people to buy high and sell low, chase trends, or fall for scams promising “guaranteed” returns. I almost made that mistake myself. At a local financial seminar, a representative pitched a private investment opportunity with a “guaranteed 7% annual return.” It sounded too good to be true—and it was. I didn’t sign up that day, but I was tempted. It wasn’t until I brought the materials to a workshop and asked the instructor to review them that I saw the red flags: lack of transparency, high fees, no clear exit strategy, and pressure to act quickly. That experience taught me a critical rule: if something sounds too good to be true, walk away. Real investing is boring. It’s slow. It’s steady. But it’s also safe.

I also learned to protect my portfolio from myself. I used to check my account balances daily, and every market dip caused anxiety. Now, I limit my reviews to quarterly statements and scheduled rebalancing dates. This reduces emotional interference and helps me stay focused on the long term. I implemented stop-loss strategies for certain holdings, which automatically sell a position if it drops by a set percentage, helping to limit losses. I also consolidated my accounts to reduce complexity. Instead of managing three 401(k)s and two IRAs, I rolled the old 401(k)s into a single IRA with a low-cost provider. This made tracking easier and reduced fees significantly. I discovered that some of my old accounts were charging over 1.5% in annual fees—money that was quietly draining my returns. By switching to providers with expense ratios under 0.2%, I saved hundreds of dollars each year. That might not sound like much, but over a decade, it adds up to thousands in preserved capital.

Another form of risk control is understanding tax efficiency. I learned that not all accounts are taxed the same way. Withdrawals from traditional IRAs and 401(k)s are taxed as ordinary income, while Roth accounts offer tax-free growth and withdrawals. I began strategizing my withdrawals to minimize tax burdens in retirement. For example, I plan to take required minimum distributions (RMDs) from my traditional accounts first, then supplement with tax-free Roth funds. I also avoid selling investments in taxable accounts unless necessary, to limit capital gains taxes. These strategies don’t make me rich, but they help me keep more of what I’ve earned. Risk control isn’t about avoiding all loss—it’s about managing it wisely. And in retirement, preserving capital is just as important as growing it.

Real-Life Gains: How Small Changes Built Real Security

I didn’t turn my financial situation around with a single bold move. There was no windfall, no lucky stock pick, no inheritance. What changed was the accumulation of small, smart decisions made consistently over time. One of the first things I did was consolidate my retirement accounts. I had three old 401(k)s from previous jobs, each with different fees and investment options. Rolling them into a single IRA not only simplified management but also gave me access to better, lower-cost funds. That one step saved me over $400 a year in fees alone. I also started contributing $100 per month to a retirement income fund, even though I was close to retirement age. It wasn’t much, but with compound interest and dividend reinvestment, that small amount has grown steadily.

I optimized my tax strategy by converting part of my traditional IRA to a Roth IRA over several years, a process known as a “Roth conversion.” By doing this in lower-income years, I paid less in taxes and created a pool of tax-free money for the future. I also reviewed my Social Security claiming strategy. Instead of taking benefits at 62, I decided to wait until 67, when I’ll receive 100% of my full benefit. That decision will increase my monthly payments by nearly 30% compared to early claiming. While it means delaying income now, it provides greater security later, especially if I live into my 80s or beyond. I also reduced unnecessary expenses—canceling unused subscriptions, refinancing my mortgage at a lower rate, and cooking at home more often. The money saved didn’t go to vacations or luxuries—it went straight into retirement savings.

Over five years, these changes transformed my financial outlook. My passive income—dividends, interest, and eventually Social Security—now covers my basic living expenses. I don’t live extravagantly, but I live without fear. I no longer worry about unexpected bills or market downturns. The compounding effect of disciplined habits proved more powerful than any single investment. I didn’t need to become an expert or take big risks. I just needed to be consistent, informed, and patient. The real gain wasn’t just in dollars—it was in peace of mind. Knowing that I have a plan, that I understand my finances, and that I can adapt when needed has given me a sense of control I never had before.

Sharing Knowledge: Teaching Others in My Community

Once I stabilized my own financial situation, I felt a strong desire to give back. I returned to the community center where I had first learned about retirement planning and volunteered to help facilitate the same workshops that had helped me. At first, I just assisted with materials and logistics. But as I grew more confident, I began co-leading sessions on budgeting, investment basics, and retirement income strategies. I shared my story—not to boast, but to show others that it’s never too late to start. Many attendees were in their 50s and 60s, just like I had been, overwhelmed by confusion and regret. Hearing that someone else had been in the same place—and had made real progress—gave them hope.

One woman told me she had been too afraid to even open her retirement statements. After our session on understanding account fees, she reviewed her investments and discovered she was paying over $600 a year in unnecessary charges. She switched to a low-cost provider and redirected that money into her retirement fund. Another man, a retired teacher, had been considering a high-fee annuity sold by a family friend. After we discussed the risks and alternatives, he decided to keep his money in a diversified portfolio instead. These moments reminded me that financial literacy is not just personal—it’s communal. When one person learns, the ripple effect can reach many others. I also started a small discussion group where retirees and near-retirees could share tips, ask questions, and support each other. We talk about everything from healthcare costs to part-time work options. The sense of solidarity is powerful. We’re not alone in this journey, and together, we’re stronger.

The Long Game: Retirement as a Phase of Growth, Not Decline

Retirement is often portrayed as an end—a finish line after decades of work. But for me, it has become a new beginning. With financial pressure reduced, I’ve been able to explore interests I once put aside. I took a part-time consulting role in my former field, not because I need the money, but because I enjoy staying engaged. I also enrolled in adult education classes—history, photography, even basic Spanish. My relationship with money has fundamentally changed. It’s no longer a source of stress or shame. It’s a tool I understand and manage with care. I view my portfolio not as a gamble, but as a foundation for stability, dignity, and freedom.

I’ve also learned to measure success differently. It’s not about having the biggest balance or the most luxurious lifestyle. It’s about having choices. It’s about being able to say no to things that don’t serve me and yes to things that bring joy. It’s about sleeping well at night, knowing I’ve done my best to prepare. The real return on my investments isn’t just in dollars—it’s in time, peace, and the ability to live on my own terms. I still review my plan regularly, adjust as needed, and stay informed. The world changes, markets shift, and life throws surprises. But I now have the knowledge and discipline to adapt. Retirement isn’t the end of productivity. It’s a phase of growth, learning, and contribution. And for the first time in a long time, I’m not just surviving—I’m thriving.