How I Turned My Debt Crisis Around Using Smarter Investment Tools

What happens when your debts feel like a sinking ship and every payment pulls you deeper? I’ve been there—overwhelmed, stressed, and stuck in a cycle I couldn’t break. But instead of giving up, I discovered that the right investment tools, used wisely, can actually help regain control. This isn’t about getting rich quick—it’s about strategic moves that stabilize your finances. It’s about creating small streams of income while staying disciplined with debt repayment. Let me walk you through how I restructured my path from crisis to clarity, not through luck or windfalls, but through practical, measured decisions that anyone can learn from. The journey wasn’t easy, but it was possible because I stopped treating debt as just a number and started seeing my finances as a system that could be rebuilt.

Hitting Rock Bottom: The Moment I Faced My Debt Reality

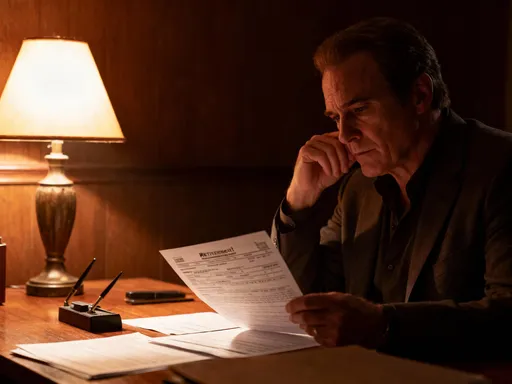

There was a moment, clear and cold, when I could no longer pretend everything was under control. It wasn’t a single bill or missed payment that broke me—it was the accumulation. Credit card balances hovered near their limits, student loan statements arrived like clockwork with no end in sight, and my car loan felt heavier each month. I remember sitting at my kitchen table one evening, surrounded by envelopes, calculator in hand, realizing I was spending more than 40 percent of my monthly income just to stay current. The rest? Barely enough to cover groceries, utilities, and the occasional gas refill. Sleep became elusive. I’d lie awake, heart racing, thinking about interest rates compounding faster than I could pay them down.

The emotional toll was just as damaging as the financial strain. I felt isolated, ashamed, and afraid to talk about it—even with close friends. I compared myself to others who seemed to manage effortlessly, wondering what I was doing wrong. Denial had been my default for years: I told myself I’d catch up next year, that a raise or bonus would fix everything. But the numbers didn’t lie. I wasn’t catching up. I was falling behind. The wake-up call came when I overdrew my checking account trying to cover a medical co-pay. That small failure forced me to confront the truth: I wasn’t managing my money—I was reacting to it, and losing.

That moment of clarity became the foundation of change. I stopped blaming myself and started analyzing the system. I gathered every statement, listed every debt with its balance, interest rate, and minimum payment, and created a full picture of my financial landscape. The total number was staggering, but seeing it in black and white removed the fog of anxiety. For the first time, I wasn’t just feeling the weight—I was measuring it. And in that measurement, I found power. Acknowledging the full scope of my debt wasn’t surrender; it was the first real step toward recovery. Without that honest assessment, no strategy would have worked. It taught me that financial healing begins not with a solution, but with the courage to see the problem clearly.

Why Traditional Payoff Methods Fell Short for Me

Once I had my debts mapped out, I turned to the most commonly recommended strategies: the debt snowball and the debt avalanche. The snowball method, which focuses on paying off the smallest balances first for psychological wins, appealed to me emotionally. The avalanche method, which targets the highest-interest debts first to save money over time, made logical sense. I tried both, alternating between them as my motivation shifted. I paid off a $300 store credit card early, which felt great. Then I attacked my 19 percent APR credit card with extra payments. But despite these efforts, my overall situation didn’t improve as much as I’d hoped.

The reason became clear after a few months: these methods focus only on repayment, not income generation. While they help reduce principal, they don’t address the underlying issue of cash flow. I was still living paycheck to paycheck, and any extra money I put toward debt came from cutting corners—skipping meals out, canceling subscriptions, delaying car maintenance. These sacrifices were unsustainable. Worse, when an unexpected expense hit—a flat tire, a home repair—I had no buffer. I had to pause my debt payments or use another credit card, undoing weeks of progress. The cycle repeated, and frustration mounted.

I began to question whether paying down debt slowly, without building financial resilience, was truly sustainable. Yes, reducing interest costs matters. Yes, eliminating accounts brings relief. But what happens when life happens? What if your income doesn’t increase, but your expenses do? I realized I needed a dual approach: one that reduced debt while also creating small, reliable sources of income. I didn’t need a side hustle or a second job—those weren’t feasible with my schedule. What I needed was a way to make my existing money work harder, even in small amounts. That’s when I started looking beyond traditional payoff methods and toward tools that could generate returns without exposing me to high risk. The goal wasn’t to get rich, but to gain breathing room—to turn my money from a passive liability into an active participant in my recovery.

The Shift: Treating Debt Recovery as a Financial Rebuild

My mindset shifted when I stopped seeing debt repayment as the only path to freedom. I began to view my financial recovery as a full rebuild, not just a cleanup. This meant addressing both sides of the equation: reducing what I owed and increasing my financial capacity. I realized that cutting expenses could only take me so far. To truly regain control, I needed to generate income—not from extra work, but from my assets. This wasn’t about speculation or chasing high returns. It was about stability, predictability, and using low-risk tools that aligned with my need for safety and liquidity.

The idea of using income-generating tools during a debt crisis felt counterintuitive at first. Wouldn’t it be smarter to throw every spare dollar at the highest-interest debt? In theory, yes. But in practice, I needed a system that could withstand real life. I couldn’t afford to tie up all my money in debt payments if an emergency arose. I needed a balance—some funds dedicated to repayment, others working to produce modest returns that could eventually accelerate that repayment. This approach required discipline, but it also offered protection. By allocating a portion of my money to tools that earned interest or dividends, I created a small but steady flow of income that helped cover minimum payments, reduced my reliance on credit, and restored a sense of agency.

The key was choosing instruments that prioritized capital preservation. I wasn’t looking for growth at all costs; I needed tools that were accessible, low-volatility, and predictable. I focused on options with low entry barriers so I could start small—even $50 or $100 at a time. I also prioritized liquidity, knowing I might need to access funds quickly if an emergency occurred. This shift in thinking transformed my relationship with money. Instead of seeing every dollar as either a debt payment or a living expense, I began to see it as a resource with multiple roles. Some dollars paid bills, some built safety, and some worked quietly in the background to earn a return. This holistic view didn’t eliminate my debt overnight, but it gave me a more resilient foundation to stand on as I climbed out.

Investment Tools That Actually Help in a Crisis (Not Just in Bull Markets)

As I explored options, I focused on tools that were practical, accessible, and aligned with my risk tolerance. The first was the high-yield savings account. Unlike traditional savings accounts that offered negligible interest, these accounts provided rates several times higher, often with no fees and full access to funds. I moved a portion of my emergency cushion into one and immediately saw the difference. The interest wasn’t life-changing, but it was consistent. Over a year, it added up to enough to cover a utility bill or a car maintenance expense. More importantly, it taught me that even safe money could earn something.

Next, I looked at short-term bond funds. These invest in government or high-quality corporate bonds with maturities of one to three years. They’re less volatile than stock funds and provide regular interest payments. I chose a low-cost ETF that tracked a short-term bond index, allowing me to invest small amounts without high fees. The returns were modest—around 3 to 4 percent annually—but they were more stable than stocks and helped diversify my small portfolio. Because the bonds matured relatively quickly, I wasn’t locked in for long periods, which suited my need for flexibility.

Dividend-paying exchange-traded funds (ETFs) were another tool I adopted carefully. I selected broad-market ETFs that focused on companies with a history of stable dividend payments, such as utilities and consumer staples. These aren’t growth stocks, but they offer income and tend to be less volatile during market downturns. I reinvested the dividends at first, allowing compounding to work quietly. As my debt load decreased, I began taking the dividends as cash, using them to make extra debt payments. This created a feedback loop: the investments earned income, which reduced debt faster, which freed up more cash to invest.

Finally, I explored peer-to-peer lending platforms, which connect individual investors with borrowers seeking personal loans. I started with a small allocation, spreading my money across dozens of loans to minimize risk. The returns were higher than savings accounts—sometimes 5 to 7 percent—but I treated this as the riskiest part of my strategy and kept it small. The platform handled credit checks and loan servicing, so I didn’t have to manage collections. While not suitable for everyone, it gave me exposure to a different kind of return without entering the stock market directly. Together, these tools formed a diversified, low-volatility income strategy that worked even during uncertain times. They didn’t replace debt repayment—they supported it.

Balancing Risk and Return: The Art of Defensive Investing

With limited funds and high financial pressure, every dollar had to count. I couldn’t afford to lose money, so I embraced defensive investing—a strategy focused on preserving capital while earning modest returns. The core principle was simple: never risk what you can’t afford to lose. This meant avoiding speculative assets, staying out of individual stocks, and steering clear of complex products like options or leveraged ETFs. Instead, I focused on diversification, even on a small scale. I spread my investments across different asset classes—cash, bonds, and dividend stocks—so that a downturn in one area wouldn’t wipe out my progress.

Emotional discipline was just as important as strategy. It’s easy to panic when markets dip or to get excited when they rise. I set clear rules for myself: no reacting to daily market news, no chasing hot tips, and no making changes without a plan. I reviewed my portfolio quarterly, not daily. I also set boundaries for risk exposure. For example, I decided that no more than 15 percent of my investable funds would go into higher-yielding but less predictable tools like peer-to-peer lending. The rest stayed in safer, more liquid options. This structure reduced the temptation to make impulsive decisions.

Liquidity was another cornerstone of my approach. I always kept a portion of my funds accessible—enough to cover three to four months of essential expenses. This emergency buffer prevented me from having to sell investments at a loss during a crisis. I also automated contributions, setting up small, regular transfers to my investment accounts. This removed the need to time the market or decide when to invest. Over time, this consistent approach smoothed out volatility and reduced stress. Defensive investing isn’t about maximizing returns; it’s about minimizing losses and maintaining control. By prioritizing safety and stability, I created a financial environment where I could focus on long-term progress, not short-term scares.

Real Moves I Made: From Theory to Action

Knowing what to do is one thing; doing it is another. My journey from theory to action began with a simple budget review. I identified $200 per month that I could redirect—not from luxury spending, but from better management of recurring expenses. I refinanced my car loan at a lower rate, switched to a cheaper phone plan, and consolidated my highest-interest credit card into a balance transfer offer with a 0 percent introductory rate. These changes freed up cash without requiring lifestyle sacrifices.

I then allocated that $200 as follows: $100 went to extra debt payments, focused on the account with the highest interest rate after the balance transfer expired. The other $100 went into investment tools, split between a high-yield savings account (40 percent), a short-term bond ETF (30 percent), and a dividend ETF (30 percent). I started with small amounts, using fractional shares where available, and set up automatic transfers so the process was hands-off. I didn’t expect immediate results, but I committed to consistency.

There were setbacks. Early on, I overcommitted by investing too much in a peer-to-peer platform, not realizing the fees and default rates could eat into returns. I learned to read the fine print and reduce my allocation. I also reacted too quickly to a market dip, pulling funds out of my bond ETF out of fear—only to watch it recover within weeks. That mistake cost me time and income. But I didn’t give up. I adjusted my strategy, increased my emergency fund, and refined my rules. Over 18 months, the income from my investments grew from $15 a month to over $60. That $60 didn’t eliminate my debt, but it covered a credit card minimum payment—money I didn’t have to earn or borrow. It was a small victory, but it proved the system could work.

Building a Sustainable System: How I Stay on Track Today

Today, I’m not debt-free, but I’m in control. The system I built continues to evolve, but its core remains the same: consistency, discipline, and balance. I’ve automated nearly every part of my financial life. Savings and investment contributions happen automatically each payday. My debt payments are scheduled and tracked through a simple spreadsheet that I review monthly. I also do quarterly check-ins on my investment portfolio, rebalancing if needed and adjusting allocations as my goals shift.

Behavioral changes have been just as important as financial ones. I’ve learned the value of delayed gratification—waiting 30 days before making non-essential purchases, which has reduced impulse spending significantly. I track every expense, not out of obsession, but to maintain awareness. Mindful spending has become a habit: I ask myself whether a purchase aligns with my long-term goals, not just my immediate desires. Emotional discipline has replaced financial panic. When unexpected costs arise, I don’t default to credit. I tap my emergency fund or adjust my budget, knowing I have options.

The investment tools I use continue to generate income, which I now route directly toward debt reduction. As my balances shrink, I feel less burdened and more empowered. I’ve also started building a small retirement contribution, even if it’s just $50 a month. That wasn’t possible two years ago. The journey taught me that long-term stability doesn’t come from miracles or windfalls, but from daily choices that compound over time. I no longer see money as an enemy or a source of stress. I see it as a tool—one that, when used wisely, can lift you out of crisis and into a place of calm, confident control.

Recovering from a debt crisis isn’t just about clearing balances—it’s about transforming your relationship with money. The right investment tools won’t erase debt overnight, but they can restore confidence, create breathing room, and turn passive survival into active progress. My journey taught me that even in the darkest financial moments, there’s room to grow—if you choose tools that protect as they perform. Stability doesn’t come from taking big risks. It comes from making small, smart decisions, consistently, over time. And for anyone feeling trapped by debt, that’s the most hopeful truth of all.