When Your Business Crumbles: How Market Smarts Saved My Finances

Starting a business feels like building on solid ground—until it isn’t. When my company collapsed, I didn’t just lose income; I lost confidence. But in the chaos, one thing shielded me: understanding market signals before they became crises. This isn’t a success story—it’s a survival guide. I’ll walk you through how predicting shifts, not panicking, helped me rebuild smarter, protect what little I had, and spot opportunities in the rubble. If you’ve faced failure, this is for you.

The Day Everything Fell Apart

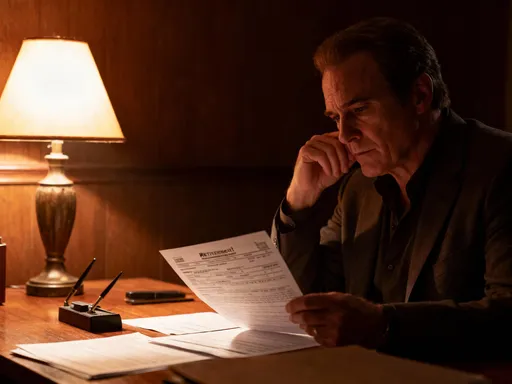

The moment my business failed wasn’t marked by a dramatic headline or a legal notice. It came quietly, in the form of a supplier’s email: "Payment overdue. Delivery suspended." That message didn’t just halt operations—it unraveled years of effort, hope, and identity. I had poured everything into a local retail venture that once showed promise: steady foot traffic, a loyal customer base, and modest but growing profits. But by the time I realized the foundation was cracking, it was too late to repair. Overhead had quietly doubled. Customer visits dropped by nearly 40% over six months, though I dismissed it as seasonal. Cash reserves evaporated, and I was left staring at a spreadsheet that no longer made sense. The emotional toll was worse than the financial one. I felt shame, confusion, and a deep sense of personal failure. As a business owner, your self-worth often becomes tied to your company’s performance. When it fails, it feels like a part of you has been erased.

Yet in the weeks that followed, I began to ask not just what went wrong, but what I had missed. The truth was, the signs had been visible long before the collapse. Industry reports had shown declining consumer spending in my sector. Competitors were adapting—some shifting online, others streamlining services. Meanwhile, I stayed focused on daily operations, believing that hard work alone would carry us through. I ignored shifts in customer feedback, brushed off delayed payments as isolated incidents, and assumed that loyalty would keep people coming back. This reactive mindset—fixing problems as they arose—left me vulnerable. I wasn’t managing risk; I was reacting to it. And by the time I tried to pivot, the window had closed. What I’ve since learned is that financial survival isn’t just about money. It’s about awareness. It’s about recognizing that denial, while comforting in the short term, compounds loss. When pride prevents honest assessment, the cost isn’t just monetary—it’s the loss of time, opportunity, and the ability to adapt before it’s too late.

Why Market Prediction Isn’t Just for Experts

For years, I believed market prediction was something reserved for economists, analysts, or investors in skyscraper offices. It sounded too technical, too abstract for a small business owner managing inventory and payroll. But after my failure, I realized that market foresight isn’t about complex models or stock charts. It’s about paying attention. It’s the ability to see patterns in everyday business interactions—what customers say, how competitors behave, and how broader economic changes affect local decisions. Market prediction, in practice, is not fortune-telling. It’s disciplined observation. It’s asking: Are fewer people returning? Are they spending less per visit? Are new businesses opening in my niche, offering similar products at lower prices? These aren’t abstract indicators—they’re real, measurable signals that any business owner can track.

I began educating myself not through advanced finance courses, but through accessible resources. Free government reports on consumer spending, industry newsletters, and even social media trends offered valuable insights. I started using simple tools like Google Analytics for my website, tracking which pages customers visited most and where they dropped off. I monitored online reviews not just for compliments or complaints, but for shifts in sentiment over time. What I discovered was that small changes often precede major disruptions. A 10% drop in repeat customers over two months might not seem alarming, but when combined with delayed payments and rising supply costs, it paints a clear picture. The key was consistency—reviewing data regularly, not just during crises. I also learned to distinguish between noise and signal. Not every fluctuation matters. But persistent trends—like declining foot traffic or increasing customer inquiries about pricing—deserve attention. Today, I view market awareness as a core business skill, as essential as accounting or customer service. You don’t need a PhD to practice it. You just need curiosity, discipline, and the willingness to face uncomfortable truths before they become unavoidable.

The Three Signals That Warn Before the Crash

In rebuilding my financial stability, I identified three critical signals that, if monitored early, can prevent total collapse. The first is customer behavior. People vote with their wallets, and subtle changes in their actions often reveal deeper shifts. When I began tracking customer retention, I noticed that repeat visits had declined steadily over several months. At first, I assumed it was due to weather or holidays. But when combined with an increase in negative feedback about pricing and service speed, the pattern became clear: customers were dissatisfied and seeking alternatives. I had failed to act because I focused on total sales, not on the health of customer relationships. Today, I track not just revenue, but customer lifetime value, repeat purchase rates, and feedback trends. A drop in any of these is a red flag.

The second signal is competitive pressure. Markets are dynamic, and new entrants can disrupt even well-established businesses. After my failure, I started monitoring local business licenses, online listings, and social media activity in my sector. I noticed when new competitors emerged, how they priced their offerings, and what unique value they provided. One competitor introduced a subscription model that I had dismissed as irrelevant—until I saw how quickly customers migrated. Competition isn’t just about price; it’s about convenience, perception, and innovation. Ignoring it means assuming your position is secure, which is rarely true. By staying aware of competitor moves, I can adjust my own strategies proactively—whether through service improvements, targeted promotions, or operational efficiencies.

The third and often overlooked signal is macro trends. These are broader economic forces—interest rate changes, inflation, supply chain disruptions, or regulatory shifts—that impact all businesses, especially small ones with limited buffers. When fuel prices rose, delivery costs for my suppliers increased, which eventually passed on to me. I hadn’t anticipated this because I wasn’t tracking energy markets or logistics reports. Now, I review monthly economic summaries and stay informed about policy changes that could affect my industry. For example, new environmental regulations might increase packaging costs, or a rise in interest rates could reduce consumer borrowing and spending. These aren’t distant concerns—they’re direct threats to cash flow. By integrating all three signals—customer behavior, competition, and macro trends—I’ve built a more resilient decision-making framework. It’s not about reacting to each change, but about understanding how they interconnect and preparing accordingly.

Building a Financial Safety Net That Actually Works

After my business failed, I made one priority clear: never again would I operate without a functional financial safety net. But I quickly learned that a safety net isn’t just about saving money—it’s about structuring finances to withstand shocks. I began by separating personal and business funds completely, something I had neglected before. I established a personal emergency fund covering at least six months of essential living expenses, held in a liquid, low-risk account. This wasn’t about luxury; it was about breathing room. When income fluctuates, knowing your basic needs are covered reduces panic and prevents rash decisions.

I also restructured my approach to fixed costs. In my previous venture, I had committed to long-term leases and high overhead, believing that a professional space signaled success. But when revenue dropped, those fixed costs became anchors. Now, I prioritize flexibility. I use shared workspaces, negotiate shorter lease terms, and outsource non-core functions instead of hiring full-time. This leaner model allows me to scale up or down based on demand. I also diversified income streams—not by chasing get-rich-quick schemes, but by identifying low-risk opportunities aligned with my skills. For example, I began offering consulting services based on my industry experience, which required minimal investment but generated steady side income.

Another key element was insurance and risk mitigation. I now carry business interruption insurance, liability coverage, and protect key suppliers with backup agreements. These aren’t expenses to cut—they’re essential safeguards. I also adopted a micro-investment strategy, allocating small amounts regularly into diversified index funds. This isn’t speculative; it’s long-term wealth building. The psychology of financial discipline was just as important as the mechanics. Fear can lead to either reckless risk-taking or complete withdrawal from opportunity. I found balance by setting clear financial rules: no major decisions without data, no spending beyond a defined threshold, and regular reviews of all financial commitments. This structure doesn’t eliminate risk—it manages it. And that shift, from living on the edge to operating from a position of strength, has been transformative.

Turning Failure into Foresight: A Practical Framework

One of the most valuable tools I developed after my business collapse is a simple monthly review system—a practical framework to assess financial and market health before problems escalate. It’s not a complicated dashboard or proprietary software. It’s a checklist I update every 30 days, focusing on three core areas: cash flow trends, customer metrics, and external risks. For cash flow, I track incoming revenue, payment delays, and upcoming obligations. A consistent downward trend over two months triggers a deeper review. For customers, I monitor retention rates, average transaction value, and feedback sentiment. A drop in any of these prompts outreach to understand why.

The external risk section includes competitor activity, supply chain updates, and macroeconomic indicators. I subscribe to free industry alerts and set up Google News notifications for keywords related to my field. This system forces me to step back from daily operations and evaluate the bigger picture. It’s not about predicting every disruption, but about catching trends early enough to respond. For example, I once noticed that a key supplier was experiencing delivery delays across multiple clients. Instead of waiting to be affected, I contacted alternative vendors and secured backup inventory. When the supplier later increased prices by 20%, I was already prepared.

The power of this framework lies in its consistency, not its complexity. It takes less than an hour to update, but it prevents the kind of blind spots that led to my failure. I don’t aim for perfection—some months show no concerning signals, and that’s fine. The goal is awareness, not alarm. Over time, this habit has reshaped my decision-making. I no longer wait for a crisis to act. I adjust pricing, renegotiate contracts, or test new offerings based on early data, not desperation. This proactive stance has not only protected my finances but also opened opportunities I would have missed before. The framework is adaptable—it works for freelancers, small retailers, or service providers. What matters is the discipline to use it regularly. In finance, as in health, prevention is always more effective than recovery.

Real Moves, Not Just Mindset: What I Did Differently

After my business failed, I spent months reflecting, learning, and planning. But I knew that insight without action was meaningless. So I began making concrete changes—small, measured steps grounded in the lessons I had learned. The first was pivoting to a leaner business model. Instead of reopening a physical store, I launched a digital-first service that required minimal overhead. I used free marketing tools, focused on email outreach, and built relationships through consistent, value-driven content. This wasn’t a grand launch—it was a test. I started with a small client base, refined my offering based on feedback, and scaled only when demand proved sustainable.

I also embraced digital efficiency. I automated invoicing, used cloud-based accounting software, and outsourced administrative tasks to reduce time and cost. These tools weren’t expensive, but they saved hours each week and improved accuracy. I stopped equating busyness with productivity. Instead, I focused on high-impact activities—client engagement, strategic planning, and market monitoring. Another critical move was forming partnerships. I collaborated with complementary businesses to share resources, cross-promote services, and reduce individual risk. One partnership led to a joint offering that doubled our reach without doubling costs. These weren’t bold gambles—they were calculated, data-informed decisions.

Perhaps the most important shift was in timing. I used to wait for the "perfect" moment to act—waiting for more capital, better conditions, or guaranteed success. But failure taught me that the perfect moment rarely comes. Instead, I began testing ideas quickly and affordably. One side project, born from noticing a gap in local service offerings, started as a weekend experiment. Because I had tracked market demand and kept costs low, it grew into a reliable income stream within a year. Action, not just intention, creates momentum. And when that action is guided by market awareness, it becomes sustainable. I no longer chase trends—I assess them, test them, and adapt only when evidence supports the move. This approach has not made me rich overnight, but it has made me resilient. And in the long run, resilience is more valuable than rapid growth.

Rebuilding with Caution and Confidence

Today, my financial life looks different—not because I’ve achieved extraordinary success, but because I’ve learned to prioritize stability over spectacle. I’m not chasing viral growth or overnight profits. I’m building something durable, something that can weather downturns and adapt to change. The collapse of my first business was painful, but it was also clarifying. It taught me that financial security doesn’t come from ambition alone, but from awareness, preparation, and disciplined action. Market prediction isn’t about controlling the future—it’s about reducing uncertainty. It’s about seeing the storm coming and having an umbrella ready.

I’ve shifted my mindset from reactive to proactive, from emotional to analytical. I still feel fear, doubt, and pressure—but now I have tools to manage them. I review data regularly, protect my core resources, and act early, not urgently. I’ve learned that failure isn’t a sign of weakness; it’s often the result of information gaps, not effort gaps. And with the right habits, those gaps can be closed. The journey back wasn’t fast, and it wasn’t easy. But it was possible because I focused on what I could control: my awareness, my decisions, and my response to change.

To anyone who has faced business failure, financial loss, or the fear of starting over—know this: you are not alone, and you are not finished. The most valuable asset you can develop isn’t capital, connections, or even experience. It’s foresight. It’s the ability to listen to the market, interpret its signals, and act with calm confidence. With that skill, you don’t just survive setbacks—you learn from them, grow beyond them, and build a future that’s not just successful, but sustainable. That’s the real reward of financial wisdom: not avoiding failure, but turning it into lasting strength.